When I returned from my first ever backpacking trip, I was flat broke. And, when I went through my bank statements from the 6 months I had spent in South America, I saw that I had racked up over £300 in banking fees simply for withdrawing cash and using my card. That £300 would have come in very handy to me but instead, it was inflating the billion-pound profit margin at HSBC. I learned a valuable lesson that day and vowed to never repeat that folly again.

If you are traveling the world on $10 a day, the last thing you need is hefty ATM and conversion fees from your local bank. This is where clever travel banking comes into play. By properly organising your online travel banking you can save money, cut your spending and make sure you don’t get a nasty surprise like a blocked debit card! If ever there is a way to dampen the travel vibes, it’s a blocked bank card.

To learn everything you need to know about travel banking, let’s dive straight in! In this post, we shall cover…

Top Travel Banking Hacks For Backpackers

Let’s take a look at the essential travel banking hacks that every backpacker should know.

Avoid ATM fees

There is nothing more frustrating when it comes to travel banking than being charged unnecessary fixed ATM bank fees every time you make a transaction from a foreign ATM. These transaction fees are usually substantial and can easily be the cost of your transport or the price of a beer.

For example, my bank charges me a fixed fee of £2.75 ($4) every time I use an overseas ATM. This is in ADDITION to local ATM fees which can be another $4. That means that if you withdraw $10, you wrack up another $8 in fees. Madness right?

So what to do?

My number one tip for stretching your money further may seem a little counterintuitive but I suggest withdrawing large amounts of cash at once, rather than extracting money each day. Paying $8 in fees on $10 is ridiculous whereas paying the same $8 on $100 is far more sensible.

I know that in certain countries it can leave you feeling a little wary if you are carrying large wads of cash on you, so investing in a money belt with a hidden security pocket is a good move.

You should always have emergency cash hidden on you – pick up this awesome security belt with its hidden pocket before you travel, it’s perfect for hiding money, a passport photocopy.

GET IT HEREMore Ways To Reduce ATM Fees!

There is more you can do as well;

- Choose a global ATM banking network that has free ATM withdrawals. An international bank such as HSBC is a good starting point but DO check your account T & C’s. If you’re from the UK, I recommend Norwich and Peterborough; they have zero fees as long as you deposit £500 a month.

- Always make sure to ask your bank about their fees before you hit the road so you know what you are in for.

- Pick ATMs in secure locations at major banks – fees tend to be lower than the “convenience” ATMs in hostels, shops or bars which are privately operated for profit.

- Finally and most importantly, invest in a dedicated Travel Bank Card. See below…

Get a Travel Cash Cards

Travel cash cards are a great alternative to credit or debit cards. To use them, you simply pre-load the card with the amount you want. Some advantages of using these are;

- They allow you to carefully manage your expenditure.

- Safety – if you have it stolen or cloned, then the thieves can only get the amount loaded onto the card and can’t clean out your bank account.

- Many of them have no or limited ATM Fees and zero transaction fees on card purchases. For example, Monzo and Revolut allow you to withdraw around $250 per month in cash from ATMs without any card fees. Note that the ATM provider (local bank) may still charge a fee. It is, therefore, worth “shopping around” and trying out several foreign bank ATM’s before you make a withdrawal. Often there will be 2 foreign ATMs situated right next to each other but one will charge a fee and the other will not!

Most of these cards are now managed via phone app’s allowing you to instantly load and transfer cash into and between cards and also allowing you to review your expenditure and usage at a glance. It’s also great if you need a PIN reset as it can usually be done INSIDE the app.

The greatest hack is to obtain multiple travel cards in order to make the most of the fee-free withdrawal amounts. Personally, I have both Monzo and Revolut so I can withdraw $500 per month without paying fees.

The Travelex prepaid currency card is also well worth checking out, it can…

- Be loaded with Euros, British Pounds, Australian dollars, Japanese yen, Canadian dollars and Mexican Pesos, US dollars and a whole bunch of other currencies.

- Be used abroad at millions of locations.

- Be reloaded whilst on the road.

Getting Excellent Exchange Rates

For this step of travel banking, you need to familiarise yourself with the exchange rate of the country you are going to. There are a tonne of currency exchange apps you can download onto your phone but my favorite is XE Currency Pro which is completely free! There are also some great online tools available. Knowledge is power and knowing the rate stops you been unduly ripped off.

My next piece of advice is to avoid currency exchange booths. Usually, people flock to these at airports but this is the most likely place to get stung with high fees and poor rates. On the other hand, if you find a local money changer you can usually negotiate a bit especially if you are changing a large amount.

The best decision is usually to use ATM machines in the country you are traveling to, that way you will receive the local currency.

On the road, you will be bumping into fellow travelers constantly. If they happen to be traveling in the opposite direction to you, exchange your cash with them. I have used this trick quite a few times and swapped cash with plenty of travelers I’ve met on the road.

International Money Transfers

Personally, I often have to move money around when traveling.

I’ve found Transferwise to be the cheapest and fastest way to internationally transfer money between bank accounts.

These days, I have a Thai bank account which I use for most of my day to day living expenses, since I’m currently based in South East Asia. Sending money internationally between banks can be extremely expensive. I use Transferwise to send money, the fee can be as low as 1% and your first transfer is free if you use this link.

Transferwise, now also issue a lovely green Debit card which you can use to withdraw cash and pay for things. The new app also allows you to manage your balances and expenditure easily.

BRITISH? CLICK HERE AMERICAN? CLICK HERE

Travelex is pretty much my preferred vendor for all things travel money and I always purchase cash from these guys when I am heading somewhere like Venezuela or Pakistan and I need to stock up ahead of time.

Sourcing a Travel Credit Card

There are several travel credit cards available (depending on where you are from) that allow you to transfer and withdraw money from ATMs with zero fees under a certain limit. There really are so many pluses in getting yourself a travel credit card but which one should you choose?

The chip and pin card from Barclays bank is a solid choice. This card allows you the freedom to pay for travel with your card and then redeem travel points.

If gathering airline miles is more on your agenda, then the Chase Sapphire Preferred card is a good option. This card comes with an incredible sign-up bonus. You earn 5000 bonus points after spending $4000 in the first three months of opening your account. Sounds pretty epic to me!

Travel hacking is used by many backpackers (including myself) to get cheap/free flights and accommodation via rewards on credit cards.

No matter which travel credit card you decide to go with, make sure to have done your research comparisons on which card will be the best travel banking solution for you. Check out this post to find out a ton more about hacking travel credit cards and scoring free shit. Check out my travel banking credit cards comparison table below for some more intel…

| Travel Cards | Pros | Cons | Star Rating |

|---|---|---|---|

| Chase Sapphire Preferred Card | No foreign transaction fee & flexible rewards programme | Annual fee of $95 after year one | 5* |

| Barclay Plus Arrival Card | No Foreign transaction fees & redeem your awards with any airline or hotel chain | Not the ideal card for someone who spends less than $4,200 on credit cards a year | 4* |

| Discover It Miles | Those who want to wait one year for full bonus | If you spend a lot, this isn't the card for you. | 3* |

| Bank America Travel Awards | Get unlimited 1.5 points for every $1 you spend on all purchases everywhere | Not as competitive as Barclay Plus. | 3* |

Tell your bank

If your bank notices unusual activity on your card (making transactions abroad) it may suspend your account to prevent fraudulent activity. However, when it’s you making those transactions, a suspended bank card is a major pain in the ass.

Prevent an unwelcome surprise by informing your bank of your travel plans before you go. They will often put a note on your account to ensure your card is not frozen when you use it in the country you are traveling to.

If you are heading overseas for a longer time there will be a whole host of different aspects you will need to consider, not only banking and access to funds alone. Check out Western Union’s post How to Become an Expat for some top tips on getting yourself set up in your new home!

You should also sign up for Online Banking before you leave. It can often be easier to contact your bank online rather than trying to phone them from the other side of the globe.

Have a Spare Bank Card

Bellroy Leather Travel Wallet is out top pick for the best of the rest

Losing your bank or debit card when traveling is a monumental pain in the arse. Getting a replacement sent out to you can either prove difficult and slow, if not totally impossible. Therefore do not ever leave home without at least 2 cards in hand. This can be 2 different bank accounts, a bank account plus a credit or pre-paid travel card, or all of the above.

Also make sure NOT to leave them all tucked in your wallet – if you lose it, you lose them all! Leave safely stored with your bags and passport.

Stop Any Unneeded Direct Debits

So you’re all set to go backpacking around Southeast Asia. See you in 6 months home! You’ve packed your bag, sorted your Visa and even got a Yellow Fever jab. But have you remembered to review your direct debits? If you’re going to be in Thailand for the foreseeable, then do you really need to be paying $20 per month for PureGym in Brighton?! How about that US Sim card which isn’t going to work overseas?

I always review my Direct Debits before beginning a trip to see if there is anything I can cancel and usually save myself a few bucks per month. Obviously, check the Direct Debit cancelation terms before you do this to avoid late payment fees.

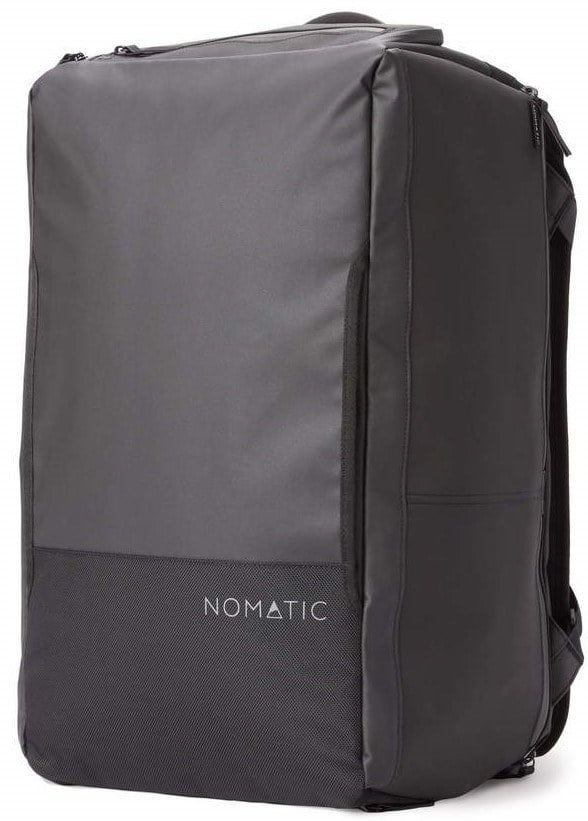

Pssssst! Not picked the perfect travel backpack yet? The Broke Backpacker team has tried out over thirty backpacks this year! Our favourite carry on backpack is the Nomatic Travel Bag.

Read our full review!

Hide Your Cash

Whether you are carrying $50 in your wallet, or $5000 in your backpack, you absolutely need to take care to hide your money when traveling. Sadly, travellers are often a target for street thieves and even hostel dorms are not as safe as we would like to think.

Protect whatever cash you have by hiding it. For tips and tricks, check out this post on the best ways to hide your money when traveling.

I strongly recommend keeping your cards in an RFID blocking wallet.

Happy banking Amigo’s!

Yay for transparency! Some of the links in this post are affiliate links. This means that if you book your accommodation through the site, The Broke Backpacker will earn a small commission at no extra cost to you. Your support helps me keep the site going.

Need More Inspiration?

- The ULTIMATE Backpacking Packing List

- How To Find CHEAP Flights

- Backpacker Insurance Guide

Like this post? PIN ME!!

Comments

Post a Comment